TIF District Information

Tax Increment Financing (TIF) District

Tax Increment Financing (TIF) is a redevelopment tool used by municipalities across Illinois to promote economic growth and reinvestment in areas that are underutilized, blighted, or in need of improvement. The Illinois State Comptroller reports that there are nearly 1,500 TIF Districts from more than 500 municipalities in the State of Illinois.

Click here for list of municipalities with TIF Districts.

TIF is not a new tax but a method of allocating future increases in property tax revenues to fund public infrastructure, redevelopment, or other improvements within a designated district.

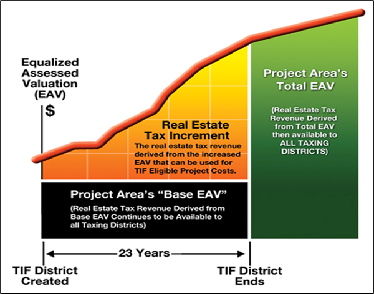

When a TIF district is established, the property values within that area are frozen at their current level, known as the base Equalized Assessed Valuation (EAV). Over time, as redevelopment occurs and property values rise, the additional tax revenue generated, called the tax increment, is set aside in a special fund. These funds are then reinvested back into the TIF district to support projects such as public infrastructure improvements, site improvements, or other assistance to private development that benefits the broader community.

TIF districts are designed to encourage private investment, revitalize aging or vacant properties, and enhance the long-term tax base of the City, all without increasing the tax rate for local residents.

How Does a TIF work?

- Increased property tax increments result from an increase in the Equalized Assessed Value (EAV) of the redevelopment project area, above the Base EAV, over the life of the TIF District.

- Increased property tax increments are re-allocated for deposit to the municipalities’ Special Tax Allocation Fund (TIF Fund).

- These funds are then reinvested back into the TIF District, for expenses such as public infrastructure improvements, site improvements, or other types of assistance to private development.

- After the TIF ends, all taxing districts benefit from the growth that occurs within the redevelopment project area.

Proposed Chestnut Court Shopping Center TIF District

To encourage redevelopment of the underutilized/distressed Chestnut Court Shopping Center, the City of Darien is exploring the creation of a Tax Increment Financing (“TIF”) District for the property, which is located at the southeast corner of 75th Street and Lemont Road.

This site was identified in City’s

2022 Comprehensive Plan Update as Key Development Area #1, with the intent to prioritize mixed-use redevelopment, with addition focus on filling existing tenant vacancies and improving the aesthetics of the site (i.e. façade enhancements).

.png.aspx) Future Public Hearing

Future Public Hearing

- September 15, 2025 – Public Hearing, 7:00PM in Darien City Hall Council Chambers (1702 Plainfield Road)

Additional Resources